Assume Amp Corporation Calendar Year End Has 2021

assume amp corporation calendar year end has 2021

assume amp corporation calendar year end has 2021 2021

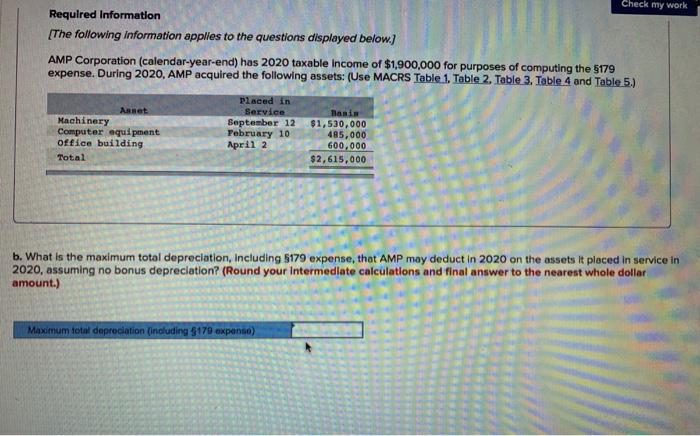

- During 2020 amp acquired the following assets.

- Assume that ernesto purchased a digital camera on july 10 of year 1 for 3 000.

- Amp corporation calendar year end has 2019 taxable income of 1 900 000 for purposes of computing the 179 expense.

- Use macrs table 1 table 2 table 3 table 4 and table 5 asset placed in service basis machinery september 12 1 550 000 computer equipment february 10 365 000 office building april 2 480 000 total 2 395 000 b.

Use macrs table 1 table 2 table 3 table 4 and table 5. Placed in asset service basis machinery september 12 1 320 000 computer equipment february 10 380 000 office building april 2 495 000 total 2 195 000 1 what is the maximum amount of. During 2019 amp acquired the following assets.

Post a Comment for "Assume Amp Corporation Calendar Year End Has 2021"